Types of business loans pdf Swan Island (Victoria)

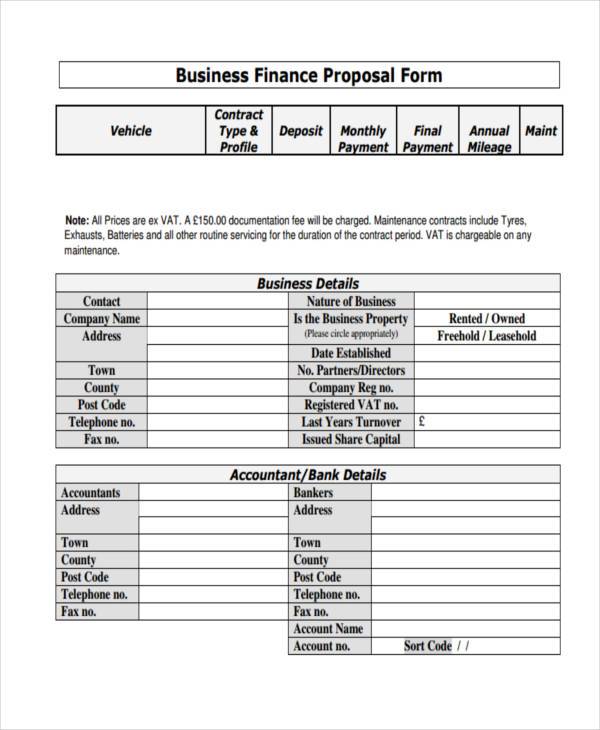

Loan types and business terms Realkredit Danmark Compare small business loans You have selected Enquire now Enquire now Unsecured Business Overdraft Access up to $50k additional funds in your business …

Types of Business Loans in India How to Apply Documents

Sources of Finance in Business Types of Business Finance. A Brief Overview of The Different Types of Business Loans. Before you get a loan for your business, we recommend you take a look at the different types of business loans available so you can find the right loan for your needs., There are two types of loans offered by the black business loan fund; the direct loans up to a maximum of $100,000 as well as the loan guarantees that also go up to $100,000. If your business is African-American owned, then this could be one of the loans that you can quickly qualify for..

pdf format. Financing is needed to start a business and ramp it up to profitability. There are several sources to consider when looking for start-up financing. But first you need to consider how much money you need and when you will need it. The financial needs of a business will vary according to the type and size of the business. For example, processing businesses are usually capital Learn more about types of business loans available in India.

Business, be it big or small, is always in need of funds. Whether the promoters pool in money or raise money from the market depends on the size and business viability.

Types of Business Loans There are thousands of business lenders offering commercial loan products, but nearly all business loans are a variation of a handful of debt financing products — but each with their own individual characteristics. Causes and Control of Loan Default/Delinquency in Microfinance Institutions in Ghana Alex Addae-Korankye Central University College BOX DS 2310, Dansoman Accra, Ghana Abstract The study analysed the causes and control of loan delinquency/default in microfinance institutions in Ghana. Random sampling technique was used to select twenty-five microfinance institutions and two …

5/08/2018 · There are many types of business loans including unofficial business scenarios where you take an equity loan on your home to finance the business or your father-in-law gives you a loan … CANSTAR’s Business Loans star ratings are aimed to provide results that suit each of the borrowing profiles for business overdrafts and business loans. Just so we’re clear on the definition… A business overdraft is a facility attached to a savings, debit, or checking account.

The ANZ Business Loan has a minimum loan amount of $10,000. Terms and conditions apply. We offer competitive interest rates for our business loans. Certain … Installment loans may be written to meet all types of business needs. You receive the full amount when the contract is signed, and interest is calculated from that date to the final day of the

A business loan up to $100,000 for unsecured loans, or $500,000 for secured loans that you can use for any business purpose. Transparent costs and redraw facility available. Transparent costs and Corporate loans are loans made to businesses for a specific business purpose. There are many types of corporate loans, and lenders change interest rates for these loans based on risk and market conditions, just like individual loans.

There are various types of business loans available in the market today and you must know amount them properly before you initiate the process of searching for the best business loan. Let us talk about the common business loans available in the market today. Types of finance ; Sources of finance ; If you’re starting or expanding your business you may need to obtain finance. Carefully consider the type of finance as it …

· Fixed rate loan: Similar to other types of loans, such as home loans or personal loans, a business loan can come with a fixed or variable interest rate. A fixed interest rate is set by your lender for a period of time (usually between one and five years). Types of Disaster Loans SBA offers four different types of financial assistance to businesses (and even homeowners) that experience damage resulting from a declared disaster.

28/06/2018 · The types of transactional documents used vary somewhat by the nature of a business. An insurance agent, for example, generates insurance applications and policies, while a lender uses loan Understanding the types of business loans can help determine the best financing for you. We outline pros and cons of 10 types of business loans. We outline pros and cons of 10 types of business loans.

CANSTAR’s Business Loans star ratings are aimed to provide results that suit each of the borrowing profiles for business overdrafts and business loans. Just so we’re clear on the definition… A business overdraft is a facility attached to a savings, debit, or checking account. ANALYSIS OF THE CREDITWORTHINESS OF BANK LOAN APPLICANTS UDC 336.717.5 Daniela Feschijan UNWE, Sofia, Bulgaria Department of Accounting and Analysis Abstract. The current article presents a model of creditworthiness analysis of bank loan applicants. The author emphasizes the possibility of using accounting information when analyzing the creditworthiness of loan applicants. …

Business loans charge interest rates in slightly differently way to other types of loans – they charge a risk margin based on how the lender views the business’s prospects for success. As well as interest charges, there are also fees that are charged on business loans. NAB Business Options Loan Economic cost and fees may apply if you swap from a fixed to a variable interest rate before the end of a fixed rate period, or if you make additional repayments during a …

Glenelg Finance Business Loans

Types of Corporate Loans Bizfluent. Types of Business Loans It takes a lot of money to maintain a business, usually more than the average entrepreneur has access to. Normally, a business owner will need different types of business loans periodically throughout the lifespan of the organization to …, Unsecured Loans. Banks will lend money to a small business owner on an unsecured basis. Most often this is in the form of a credit card, a personal loan or a short term line of credit..

Types of Corporate Loans Bizfluent. Glenelg Finance offers 3 main business loans, Chattel Mortgage, Leasing and Commercial Hire Purchase (CHP). Glenelg Finance has experienced staff who can explain these options to help you make the right decision with your business loan, SBA loans: The SBA backs various types of small-business loans made through local banks and agencies. These loans can be used to buy equipment, inventory, furniture, supplies and more. For.

The 6 Different Types of Business Loans

Business Loans & What Business Owners Want Canstar. 28/06/2018 · The types of transactional documents used vary somewhat by the nature of a business. An insurance agent, for example, generates insurance applications and policies, while a lender uses loan Types of Interest Available for Business Loans Few businesses are able to make major purchases without taking out loans. Businesses must pay interest, a percentage of the amount loaned, to whoever loans them the money, whether loans are for vehicles, buildings, or other business needs..

Installment loans may be written to meet all types of business needs. You receive the full amount when the contract is signed, and interest is calculated from that date to the final day of the 28/06/2018 · The types of transactional documents used vary somewhat by the nature of a business. An insurance agent, for example, generates insurance applications and policies, while a lender uses loan

Unsecured Loans. Banks will lend money to a small business owner on an unsecured basis. Most often this is in the form of a credit card, a personal loan or a short term line of credit. Top 10 Types of Startup Business Loans Getting a startup off the ground takes more than a great idea; you also need money. Too many new businesses fail due to lack of initial capital.

· Fixed rate loan: Similar to other types of loans, such as home loans or personal loans, a business loan can come with a fixed or variable interest rate. A fixed interest rate is set by your lender for a period of time (usually between one and five years). · Fixed rate loan: Similar to other types of loans, such as home loans or personal loans, a business loan can come with a fixed or variable interest rate. A fixed interest rate is set by your lender for a period of time (usually between one and five years).

There are two types of loans offered by the black business loan fund; the direct loans up to a maximum of $100,000 as well as the loan guarantees that also go up to $100,000. If your business is African-American owned, then this could be one of the loans that you can quickly qualify for. Types of Business Loans There are thousands of business lenders offering commercial loan products, but nearly all business loans are a variation of a handful of debt financing products — but each with their own individual characteristics.

A business loan up to $100,000 for unsecured loans, or $500,000 for secured loans that you can use for any business purpose. Transparent costs and redraw facility available. Transparent costs and There are various types of business loans available in the market today and you must know amount them properly before you initiate the process of searching for the best business loan. Let us talk about the common business loans available in the market today.

A business loan up to $100,000 for unsecured loans, or $500,000 for secured loans that you can use for any business purpose. Transparent costs and redraw facility available. Transparent costs and Top 10 Types of Startup Business Loans Getting a startup off the ground takes more than a great idea; you also need money. Too many new businesses fail due to lack of initial capital.

Types of Commercial Business Loans. Short Term Loans: Lines of Credit. A line of credit is a type of loan that allows you to draw money as you need it up to your credit limit. Payments are made and more money may be drawn based on the terms of the loan agreement. Lines of credit are designed to meet short term working capital needs, for example, boosting or expanding your inventory and helping Types of finance ; Sources of finance ; If you’re starting or expanding your business you may need to obtain finance. Carefully consider the type of finance as it …

Use this section to learn more about business loans and specific financial products that might be right for your company. Revolving Line Of Credit Revolving lines of credit are the most common and least expensive form of business loan for small- and mid-sized companies. Companies typically enter into revolving facilities to fund their working capital, which is the amount of current assets Bank loans usually have lower rates than other types of asset-based financing, but banks have much stricter credit requirements. Bank loans can be used to finance growth in …

Understanding the types of business loans can help determine the best financing for you. We outline pros and cons of 10 types of business loans. We outline pros and cons of 10 types of business loans. pdf format. Financing is needed to start a business and ramp it up to profitability. There are several sources to consider when looking for start-up financing. But first you need to consider how much money you need and when you will need it. The financial needs of a business will vary according to the type and size of the business. For example, processing businesses are usually capital

The small business financing industry has grown tremendously over the last several years. Entrepreneurs now have many types of business loans at their disposal, whether they are looking for working capital, want to buy a business, need equipment, or have another reason for getting a business … A Brief Overview of The Different Types of Business Loans. Before you get a loan for your business, we recommend you take a look at the different types of business loans available so you can find the right loan for your needs.

ing to the type and size of the business. For example, processing businesses are usually capital intensive, requiring large amounts of capital. Retail businesses usually require less capital. Debt and equity are the two major sources of fi nanc- ing. Government grants to fi nance certain aspects of a business may be an option. Also, incentives may be available to locate in certain The small business financing industry has grown tremendously over the last several years. Entrepreneurs now have many types of business loans at their disposal, whether they are looking for working capital, want to buy a business, need equipment, or have another reason for getting a business …

Types of Small Business Loans 12 Types You Should Know

ANALYSIS OF THE CREDITWORTHINESS OF BANK LOAN. NAB Business Options Loan Economic cost and fees may apply if you swap from a fixed to a variable interest rate before the end of a fixed rate period, or if you make additional repayments during a …, The syndicated loan market: structure, development and implications1 The syndicated loan market allows a more efficient geographical and institutional sharing of risk. Large US and European banks originate loans for emerging market borrowers and allocate them to local banks. Euro area banks have expanded pan-European lending and have found funding outside the euro area. JEL classification.

Compare Business Loans & Business Loan Rates Canstar

CUA Small Business Loan Guarantee Program. A Brief Overview of The Different Types of Business Loans. Before you get a loan for your business, we recommend you take a look at the different types of business loans available so you can find the right loan for your needs., An installment loan is one of the most common types of loans and one that most business owners are already familiar with in some capacity. Mortgages and vehicle loans are just two examples of installment loans..

The 6 main types of business loans are SBA loans, business lines of credit, invoice factoring or financing, business term loans, equipment financing, or a merchant cash advance option. Learn about the pros and cons of each type of business loan and we’ll … Bank loans usually have lower rates than other types of asset-based financing, but banks have much stricter credit requirements. Bank loans can be used to finance growth in …

Short term loans are ideal for managing one-off business needs and capex requirements, managing seasonal inventory increases, hiring needs, buying an asset or bridging property purchases NAB Business Options Loan Economic cost and fees may apply if you swap from a fixed to a variable interest rate before the end of a fixed rate period, or if you make additional repayments during a …

Use this section to learn more about business loans and specific financial products that might be right for your company. Revolving Line Of Credit Revolving lines of credit are the most common and least expensive form of business loan for small- and mid-sized companies. Companies typically enter into revolving facilities to fund their working capital, which is the amount of current assets Many business loan seekers think they’ll just go talk to the bank down the street, and then hope that bank will loan them money. What they often don’t know is there are myriad types of business loans, with different qualifications and rates.

Top 10 Types of Startup Business Loans Getting a startup off the ground takes more than a great idea; you also need money. Too many new businesses fail due to lack of initial capital. Types of Business Loans There are thousands of business lenders offering commercial loan products, but nearly all business loans are a variation of a handful of debt financing products — but each with their own individual characteristics.

Business loans If you're just starting out or if you want to grow your business, we have a range of flexible loans and finance solutions to suit your needs. Choose the right loan for your business Causes and Control of Loan Default/Delinquency in Microfinance Institutions in Ghana Alex Addae-Korankye Central University College BOX DS 2310, Dansoman Accra, Ghana Abstract The study analysed the causes and control of loan delinquency/default in microfinance institutions in Ghana. Random sampling technique was used to select twenty-five microfinance institutions and two …

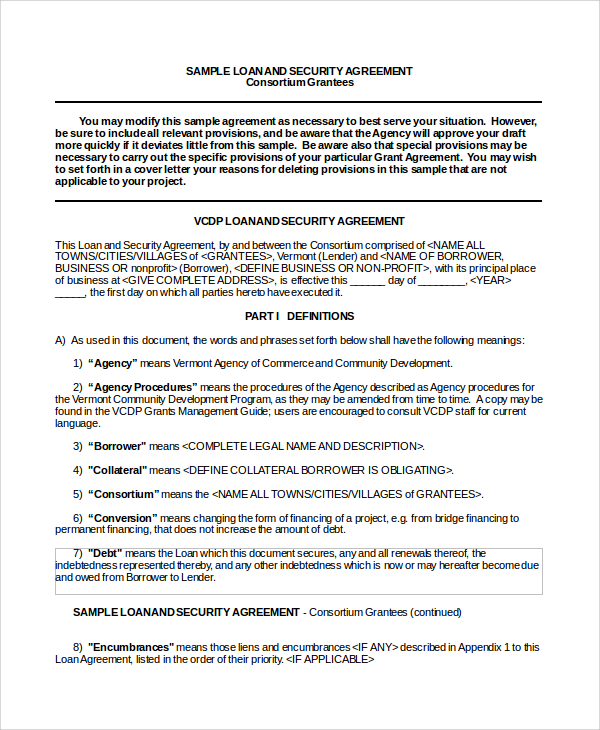

Corporate loans are loans made to businesses for a specific business purpose. There are many types of corporate loans, and lenders change interest rates for these loans based on risk and market conditions, just like individual loans. credit, a factoring agreement, or similar types of business credit in this Commercial Loan Application, and if your application for business credit is denied, you have the right to a written statement

Types of Business Loans There are thousands of business lenders offering commercial loan products, but nearly all business loans are a variation of a handful of debt financing products — but each with their own individual characteristics. credit, a factoring agreement, or similar types of business credit in this Commercial Loan Application, and if your application for business credit is denied, you have the right to a written statement

Small Business Loan Guarantee Program Helping small businesses with big ideas is why the Small Business Loan Guarantee Program was created. It is the only financing program of its kind designed to empower small businesses in Nova Scotia to succeed. Corporate loans are loans made to businesses for a specific business purpose. There are many types of corporate loans, and lenders change interest rates for these loans based on risk and market conditions, just like individual loans.

There are various types of business loans available in the market today and you must know amount them properly before you initiate the process of searching for the best business loan. Let us talk about the common business loans available in the market today. Business loans are those loans giving to individuals, groups, or organizations specifically for business purposes. Like any other form of loan system, the business loan also has its own types and we’re going to look at them one by one. Find out below, the 10 types of business loans you can find anywhere in …

A Brief Overview of The Different Types of Business Loans. Before you get a loan for your business, we recommend you take a look at the different types of business loans available so you can find the right loan for your needs. Corporate loans are loans made to businesses for a specific business purpose. There are many types of corporate loans, and lenders change interest rates for these loans based on risk and market conditions, just like individual loans.

What types of business loans are there

Top 10 Types of Startup Business Loans Lendvo. Understanding the types of business loans can help determine the best financing for you. We outline pros and cons of 10 types of business loans. We outline pros and cons of 10 types of business loans., Types of finance ; Sources of finance ; If you’re starting or expanding your business you may need to obtain finance. Carefully consider the type of finance as it ….

Comparing 15 Different Types of Business Loans Lendio

Types of Small Business Loans 12 Types You Should Know. Types of Disaster Loans SBA offers four different types of financial assistance to businesses (and even homeowners) that experience damage resulting from a declared disaster. credit, a factoring agreement, or similar types of business credit in this Commercial Loan Application, and if your application for business credit is denied, you have the right to a written statement.

5/08/2018 · There are many types of business loans including unofficial business scenarios where you take an equity loan on your home to finance the business or your father-in-law gives you a loan … The best source of small business loans is the U.S. Small Business Administration (SBA), which offers a variety of options depending on each business’s needs. Learn more about small business loans.

CANSTAR’s Business Loans star ratings are aimed to provide results that suit each of the borrowing profiles for business overdrafts and business loans. Just so we’re clear on the definition… A business overdraft is a facility attached to a savings, debit, or checking account. Types of Disaster Loans SBA offers four different types of financial assistance to businesses (and even homeowners) that experience damage resulting from a declared disaster.

Use this section to learn more about business loans and specific financial products that might be right for your company. Revolving Line Of Credit Revolving lines of credit are the most common and least expensive form of business loan for small- and mid-sized companies. Companies typically enter into revolving facilities to fund their working capital, which is the amount of current assets Compare small business loans You have selected Enquire now Enquire now Unsecured Business Overdraft Access up to $50k additional funds in your business …

Unsecured Loans. Banks will lend money to a small business owner on an unsecured basis. Most often this is in the form of a credit card, a personal loan or a short term line of credit. Business loans are those loans giving to individuals, groups, or organizations specifically for business purposes. Like any other form of loan system, the business loan also has its own types and we’re going to look at them one by one. Find out below, the 10 types of business loans you can find anywhere in …

Causes and Control of Loan Default/Delinquency in Microfinance Institutions in Ghana Alex Addae-Korankye Central University College BOX DS 2310, Dansoman Accra, Ghana Abstract The study analysed the causes and control of loan delinquency/default in microfinance institutions in Ghana. Random sampling technique was used to select twenty-five microfinance institutions and two … Bank loans usually have lower rates than other types of asset-based financing, but banks have much stricter credit requirements. Bank loans can be used to finance growth in …

Bank loans usually have lower rates than other types of asset-based financing, but banks have much stricter credit requirements. Bank loans can be used to finance growth in … Many business loan seekers think they’ll just go talk to the bank down the street, and then hope that bank will loan them money. What they often don’t know is there are myriad types of business loans, with different qualifications and rates.

Types of Commercial Business Loans. Short Term Loans: Lines of Credit. A line of credit is a type of loan that allows you to draw money as you need it up to your credit limit. Payments are made and more money may be drawn based on the terms of the loan agreement. Lines of credit are designed to meet short term working capital needs, for example, boosting or expanding your inventory and helping Types of Commercial Business Loans. Short Term Loans: Lines of Credit. A line of credit is a type of loan that allows you to draw money as you need it up to your credit limit. Payments are made and more money may be drawn based on the terms of the loan agreement. Lines of credit are designed to meet short term working capital needs, for example, boosting or expanding your inventory and helping

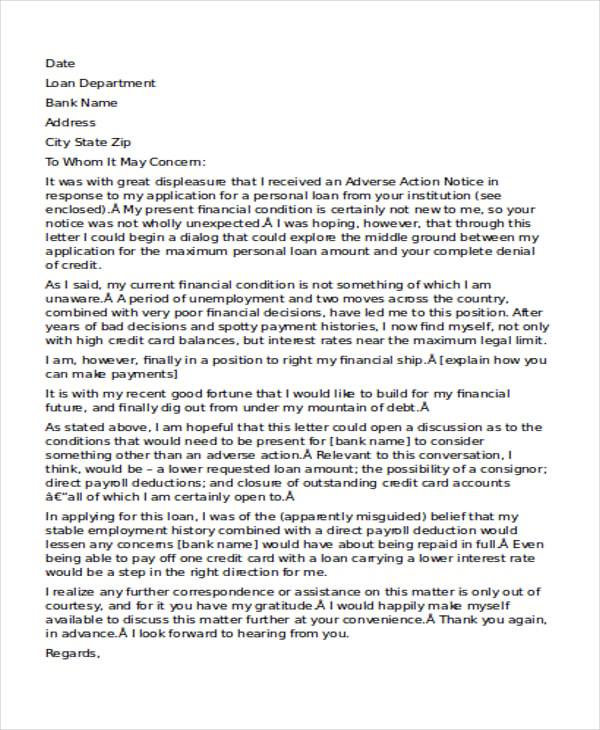

A Brief Overview of The Different Types of Business Loans. Before you get a loan for your business, we recommend you take a look at the different types of business loans available so you can find the right loan for your needs. Some lenders will grant business loans with a personal guarantee, and while these loans are similar to general business loans, the individual is the responsible party instead of the business. The

Unsecured Loans. Banks will lend money to a small business owner on an unsecured basis. Most often this is in the form of a credit card, a personal loan or a short term line of credit. To help you navigate the lending process, here are seven common types of loans and what they cover. To help you navigate the lending process, here are seven common types of loans and what they

encouraged issuers to consider a wider variety of asset types, including home equity loans, lease receivables, and small business loans, to name a few. Learn more about types of business loans available in India.

Business, be it big or small, is always in need of funds. Whether the promoters pool in money or raise money from the market depends on the size and business viability.

Types of Interest Available for Business Loans Few businesses are able to make major purchases without taking out loans. Businesses must pay interest, a percentage of the amount loaned, to whoever loans them the money, whether loans are for vehicles, buildings, or other business needs. Corporate loans are loans made to businesses for a specific business purpose. There are many types of corporate loans, and lenders change interest rates for these loans based on risk and market conditions, just like individual loans.