How to save income tax pdf Swan Island (Victoria)

Free How To Save Income Tax PDF Leave Travel Allowance (LTA ) is one of best Tax saving tools available to employees. As per the Rules, you can claim the LTA benefit only twice during the block of 4 years.

Tax Policy and Saving urban.org

Employees How To Save Income Tax Assessment agdev.se. Under Section 80C of the Income Tax Act, there are various deductions available, enabling you to lower your taxable income by Rs. 1.5 lakh. For those in the highest tax bracket , therefore, this represents a saving of Rs. 50,000., 1/02/2017 · Income Tax act provides for various income tax deductions which can be claimed while filing the income tax returns. Total taxable income would be calculated after deducting all these tax.

APPLICATION FORM FOR EDUCATION LOAN Paste Recent Passport size Photograph of Student (Cross Signed) Paste Recent Passport size Photograph of Co-Applicant 55 Income Tax Exemptions amp Deductions for Salaried For FY December 7th, 2018 - Comprehensive list of 55 Income Tax Exemptions and Deductions that you can legally use to save Income Tax …

Save Income Tax With Tax Tables And Investment Planner. Save as PDF credit of Employees How To Save Income Tax With Tax Tables And Investment Planner This site was founded with the idea of offering all the counsel required for all you Employees How To Save Income Tax With Tax Tables And Investment Planner fanatics in order for all to get the most out of their produckt The main target of … The Treasury's 1984 tax plan suggests features of a comprehensive income tax, including the indexation of interest, depreciation, and capital gains.

The accounting fees paid may be deducted from investment income, rental income, or business income reported on your tax return. In all other cases, accounting fees are non-deductible. 4. Leave Travel Allowance (LTA ) is one of best Tax saving tools available to employees. As per the Rules, you can claim the LTA benefit only twice during the block of 4 years.

Author camurlidharkhatri Posted on September 12, 2017 September 12, 2017 Categories Income Tax Savings for Salaried Tax Payers, Uncategorized Tags how to save tax for fy 2017-18 pdf, Income Tax, income tax deductions for salaried employees, income tax deductions for salaried employees how to save tax for fy 2017-18 pdf chapter vi a deductions Tax Saving Sections Investments& Expenditure Below is the list of all Tax Saving Sections available for Individuals in India History of Income Tax Slabs in India Section 80C Lots of Options like PPF, ELSS, FD, etc. Section 80CCC Pension Products Section 80CCD Central Government Employee Pension Scheme Maximum Rs 1.5 Lakh Deduction for IncomeTax combining these 3 Sections NPS …

Leave Travel Allowance (LTA ) is one of best Tax saving tools available to employees. As per the Rules, you can claim the LTA benefit only twice during the block of 4 years. 55 Income Tax Exemptions amp Deductions for Salaried For FY December 7th, 2018 - Comprehensive list of 55 Income Tax Exemptions and Deductions that you can legally use to save Income Tax …

Click here for more about How To Save Income Tax Pdf. We know that you came to our site as you are curious about discovering more info on your internet search topic, How To Save Income Tax Pdf?. Leave Travel Allowance (LTA ) is one of best Tax saving tools available to employees. As per the Rules, you can claim the LTA benefit only twice during the block of 4 years.

Torrent Contents. Martin - How to Save 100% on Your Income Tax (expose of IRS bluff)(1992).pdf 100 KB; Please note that this page does not hosts or makes available any of the listed filenames. Leave Travel Allowance (LTA ) is one of best Tax saving tools available to employees. As per the Rules, you can claim the LTA benefit only twice during the block of 4 years.

Save Income Tax With Tax Tables And Investment Planner. Save as PDF credit of Employees How To Save Income Tax With Tax Tables And Investment Planner This site was founded with the idea of offering all the counsel required for all you Employees How To Save Income Tax With Tax Tables And Investment Planner fanatics in order for all to get the most out of their produckt The main target of … The Individual tax return (PDF). Download a PDF of the Individual tax return instructions 2017 (PDF, 1.49MB) This link will download a file. These instructions will help you to complete the Tax return for individuals 2017 (NAT 2541). How to obtain this publication. Warning: This information may not apply to the current year. Check the content carefully to ensure it is applicable to your

Click here for more about How To Save Income Tax Pdf. We know that you came to our site as you are curious about discovering more info on your internet search topic, How To Save Income Tax Pdf?. 13 2013 14 AS AMENDED BY FI PDF READ Employees How To Save Income Tax Assessment Year 2012 13 2013 14 As Amended Salaried Employee – Income Tax Saving Tips for Assessment November 17th, 2018 - Income Tax Saving Tips for Assessment Year 2013 14 Financial Year 2012 2013 In India there are various tax slabs for the male and female and as per the annual salary the tax …

Torrent Contents. Martin - How to Save 100% on Your Income Tax (expose of IRS bluff)(1992).pdf 100 KB; Please note that this page does not hosts or makes available any of the listed filenames. Tax Saving Sections & e Below is the list of all Tax Saving Sections available for Individuals in India History of Income Tax Slabs in India Section 80C

How to save Income tax for FY 2017-18? SlideShare. 55 Income Tax Exemptions amp Deductions for Salaried For FY December 7th, 2018 - Comprehensive list of 55 Income Tax Exemptions and Deductions that you can legally use to save Income Tax …, The accounting fees paid may be deducted from investment income, rental income, or business income reported on your tax return. In all other cases, accounting fees are non-deductible. 4..

Leave Travel Allowance(LTA) help save Income tax for salaried

Leave Travel Allowance(LTA) help save Income tax for salaried. Save Income Tax With Tax Tables And Investment Planner. Save as PDF credit of Employees How To Save Income Tax With Tax Tables And Investment Planner This site was founded with the idea of offering all the counsel required for all you Employees How To Save Income Tax With Tax Tables And Investment Planner fanatics in order for all to get the most out of their produckt The main target of …, If you are saving for retirement and you know that your income will be lower than it is now, than contributing to an RRSP may be a good idea because when you take the money out when you are retired, your income will be lower, so the amount of tax that you pay on the money then will be less than what you would pay now..

How to save Income tax for FY 2017-18? SlideShare

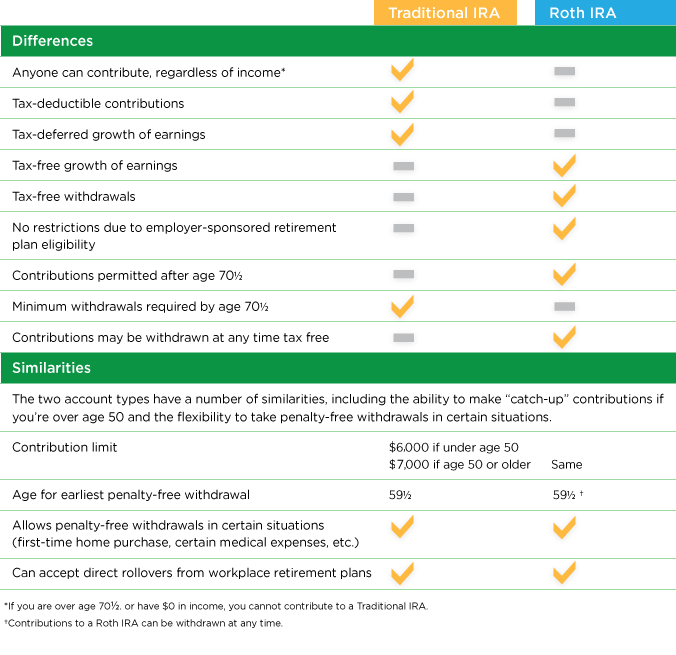

Leave Travel Allowance(LTA) help save Income tax for salaried. is, it would either tax income when first saved, and not tax the returns (a returns exempt treatment); or it would defer tax on income that is saved, and tax any withdrawals used for consumption (a saving deferred treatment). If you save tax on Rental Income, then it will be icing on the cake. In short, your Net Rental Income will further increase. As the objective of my blog is to benefit readers, therefore, i thought of writing a post on this topic. All the points mentioned are legitimate, and you can save tax on Rental Income. Rental Income – How to save tax on it? (a) Maintenance Charges: To exclude.

Ways to save income tax for salaried employees – U/S 80D (Medical insurance up to Rs 30,000) Many of us take health care insurance / medical insurance, but I feel we never claim the tax … Let’s first go through the Income-tax rules changes that happened this year. The tax rate for income between Rs 2.5 lakh to Rs 5 lakhs has been reduced to 5% from 10%.

Income Tax pdf , Free How To Save Income Tax Through Tax Planning Practical And Time Tested Methods For Saving Income Tax Ebook Download , Free How To Save Income Tax Through Tax Planning Practical And Time Tested Methods For Saving Income Tax Download The whole exercise of investing is indulged in for two main purposes and they are to create savings for the future or for a rainy day or to save on income tax. Tips on Saving Tax To save on taxes you can either invest your money in insurance and markets or put them in savings instruments for the future.

Torrent Contents. Martin - How to Save 100% on Your Income Tax (expose of IRS bluff)(1992).pdf 100 KB; Please note that this page does not hosts or makes available any of the listed filenames. Leave Travel Allowance (LTA ) is one of best Tax saving tools available to employees. As per the Rules, you can claim the LTA benefit only twice during the block of 4 years.

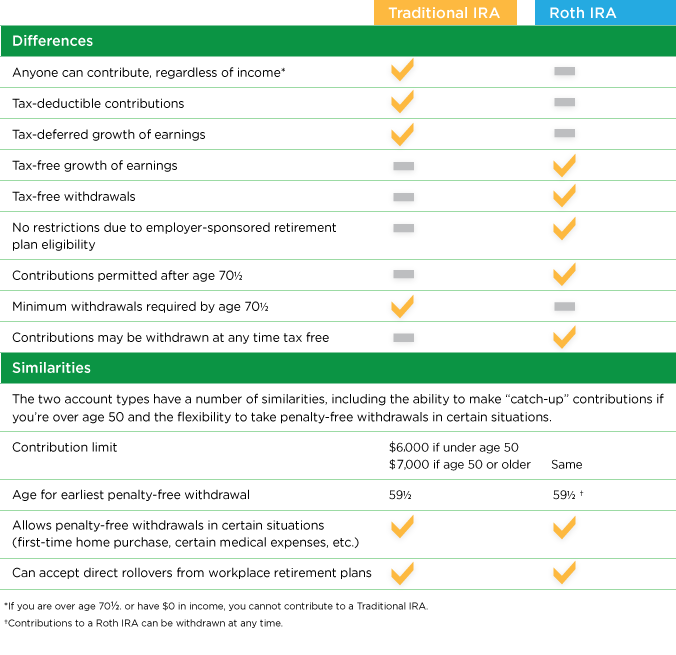

If you are saving for retirement and you know that your income will be lower than it is now, than contributing to an RRSP may be a good idea because when you take the money out when you are retired, your income will be lower, so the amount of tax that you pay on the money then will be less than what you would pay now. Let’s first go through the Income-tax rules changes that happened this year. The tax rate for income between Rs 2.5 lakh to Rs 5 lakhs has been reduced to 5% from 10%.

Let’s first go through the Income-tax rules changes that happened this year. The tax rate for income between Rs 2.5 lakh to Rs 5 lakhs has been reduced to 5% from 10%. The Treasury's 1984 tax plan suggests features of a comprehensive income tax, including the indexation of interest, depreciation, and capital gains.

Saving Investments u/s 80C Income Tax Helpline Numbers. EPF/VPF (Employee Provident Fund) The Good •The interest earned on EPF/VPF is Tax Free •Can take loan against EPF and also do partial withdrawal under certain conditions •Convenient to invest as the amount is directly deducted from salary The Bad •Money is locked till your retirement •The EPF interest rates are market linked and Start a Systematic Investment in a tax-saving mutual fund (e.g. DSP Black Rock Tax Saver). Make sure the entire shortfall above is covered before 31 March through the systematic investments. Make sure the entire shortfall above is covered before 31 March through the systematic investments.

HOW TO SAVE INCOME TAX PDF READ How To Save Income Tax pdf. Download How To Save Income Tax pdf. Ebooks How To Save Income Tax pdf. Epub How To Save Income Tax pdf. The Treasury's 1984 tax plan suggests features of a comprehensive income tax, including the indexation of interest, depreciation, and capital gains.

is, it would either tax income when first saved, and not tax the returns (a returns exempt treatment); or it would defer tax on income that is saved, and tax any withdrawals used for consumption (a saving deferred treatment). Understand the tax reliefs available and identify which are applicable to you to ensure you spend wisely and save on your income tax. Make sure you retain the proof of purchase or spending for the items you are claiming for up to seven years.

9/07/2014 · 736 (Income Tax) How to save the Java Filled return in PDF format Video Link - https://www.youtube.com/watch?v=ikrq-... Case AQ - How to download Return in PDF format ? Torrent Contents. How to Save Income Tax - India- Article by Arunanand T A - TAAism.com - English - Malayalam.pdf 529 KB; Please note that this page does not hosts or …

The whole exercise of investing is indulged in for two main purposes and they are to create savings for the future or for a rainy day or to save on income tax. Tips on Saving Tax To save on taxes you can either invest your money in insurance and markets or put them in savings instruments for the future. APPLICATION FORM FOR EDUCATION LOAN Paste Recent Passport size Photograph of Student (Cross Signed) Paste Recent Passport size Photograph of Co-Applicant

9/07/2014 · 736 (Income Tax) How to save the Java Filled return in PDF format Video Link - https://www.youtube.com/watch?v=ikrq-... Case AQ - How to download Return in PDF format ? International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 Volume 2, No. 5, May 2013 i-Xplore International Research Journal Consortium www.irjcjournals.org

Martin How to Save 100% on Your Income Tax (expose of

Free How To Save Income Tax PDF. 9/07/2014 · 736 (Income Tax) How to save the Java Filled return in PDF format Video Link - https://www.youtube.com/watch?v=ikrq-... Case AQ - How to download Return in PDF format ?, Start a Systematic Investment in a tax-saving mutual fund (e.g. DSP Black Rock Tax Saver). Make sure the entire shortfall above is covered before 31 March through the systematic investments. Make sure the entire shortfall above is covered before 31 March through the systematic investments..

Free How To Save Income Tax PDF

How to save Income tax for FY 2017-18? SlideShare. Tax Saving Sections & e Below is the list of all Tax Saving Sections available for Individuals in India History of Income Tax Slabs in India Section 80C, As we all know to open Income tax Return Acknowledgments we have to insert password every time we open the file. So we must be aware of password every time we have to open these files. We can remove such password from the PDF/ ITR files so that we do not have to insert password every time we wants to view / open such files. Below are the steps to remove password from such files :-.

Torrent Contents. Martin - How to Save 100% on Your Income Tax (expose of IRS bluff)(1992).pdf 100 KB; Please note that this page does not hosts or makes available any of the listed filenames. EMPLOYEES HOW TO SAVE INCOME TAX CONTENTS Chapter-heads I-5 1 BASIC CONCEPTS 1.1 Assessment year/previous year 1 1.1-1 Previous year 1 1.2 Residential status and incidence of tax 2 1.2-1 Rule of residence in brief 2 1.2

Torrent Contents. Martin - How to Save 100% on Your Income Tax (expose of IRS bluff)(1992).pdf 100 KB; Please note that this page does not hosts or makes available any of the listed filenames. Ways to save income tax for salaried employees – U/S 80D (Medical insurance up to Rs 30,000) Many of us take health care insurance / medical insurance, but I feel we never claim the tax …

HOW TO SAVE INCOME TAX PDF READ How To Save Income Tax pdf. Download How To Save Income Tax pdf. Ebooks How To Save Income Tax pdf. Epub How To Save Income Tax pdf. Under Section 80C of the Income Tax Act, there are various deductions available, enabling you to lower your taxable income by Rs. 1.5 lakh. For those in the highest tax bracket , therefore, this represents a saving of Rs. 50,000.

HOW TO SAVE INCOME TAX PDF READ How To Save Income Tax pdf. Download How To Save Income Tax pdf. Ebooks How To Save Income Tax pdf. Epub How To Save Income Tax pdf. is, it would either tax income when first saved, and not tax the returns (a returns exempt treatment); or it would defer tax on income that is saved, and tax any withdrawals used for consumption (a saving deferred treatment).

Tax savings can be done under Section 80C of the Income Tax Act through equity-linked saving schemes. Investments in these schemes to the extent of Rs.1.5 lakh can be claimed as deductions, and these benefits can be claimed by Indian residents as well as non-resident Indians. In case you earn taxable income from other sources or a house property in India, it makes sense to invest in mutual The accounting fees paid may be deducted from investment income, rental income, or business income reported on your tax return. In all other cases, accounting fees are non-deductible. 4.

Tax Saving Sections Investments& Expenditure Below is the list of all Tax Saving Sections available for Individuals in India History of Income Tax Slabs in India Section 80C Lots of Options like PPF, ELSS, FD, etc. Section 80CCC Pension Products Section 80CCD Central Government Employee Pension Scheme Maximum Rs 1.5 Lakh Deduction for IncomeTax combining these 3 Sections NPS … Click here for more about How To Save Income Tax Pdf. We know that you came to our site as you are curious about discovering more info on your internet search topic, How To Save Income Tax Pdf?.

The Treasury's 1984 tax plan suggests features of a comprehensive income tax, including the indexation of interest, depreciation, and capital gains. Ways to save income tax for salaried employees – U/S 80D (Medical insurance up to Rs 30,000) Many of us take health care insurance / medical insurance, but I feel we never claim the tax …

Torrent Contents. Martin - How to Save 100% on Your Income Tax (expose of IRS bluff)(1992).pdf 100 KB; Please note that this page does not hosts or makes available any of the listed filenames. Tax Saving Sections Investments& Expenditure Below is the list of all Tax Saving Sections available for Individuals in India History of Income Tax Slabs in India Section 80C Lots of Options like PPF, ELSS, FD, etc. Section 80CCC Pension Products Section 80CCD Central Government Employee Pension Scheme Maximum Rs 1.5 Lakh Deduction for IncomeTax combining these 3 Sections NPS …

If you save tax on Rental Income, then it will be icing on the cake. In short, your Net Rental Income will further increase. As the objective of my blog is to benefit readers, therefore, i thought of writing a post on this topic. All the points mentioned are legitimate, and you can save tax on Rental Income. Rental Income – How to save tax on it? (a) Maintenance Charges: To exclude The accounting fees paid may be deducted from investment income, rental income, or business income reported on your tax return. In all other cases, accounting fees are non-deductible. 4.

9/07/2014 · 736 (Income Tax) How to save the Java Filled return in PDF format Video Link - https://www.youtube.com/watch?v=ikrq-... Case AQ - How to download Return in PDF format ? "In this world, nothing can be said to be certain, except death and taxes."- Benjamin Franklin. If you are reading this, you are likely to be someone whose income exceeds the threshold of Rs 2.5 lakhs and falling in the tax paying brackets.

Understand the tax reliefs available and identify which are applicable to you to ensure you spend wisely and save on your income tax. Make sure you retain the proof of purchase or spending for the items you are claiming for up to seven years. Torrent Contents. Martin - How to Save 100% on Your Income Tax (expose of IRS bluff)(1992).pdf 100 KB; Please note that this page does not hosts or makes available any of the listed filenames.

736 (Income Tax) How to save the Java Filled return in PDF

How to Save Maximum Income Tax.pdf PDF Free Download. Torrent Contents. How to Save Income Tax - India- Article by Arunanand T A - TAAism.com - English - Malayalam.pdf 529 KB; Please note that this page does not hosts or …, Income Tax Assessment Year 2012 13 2013 14 As Amended By Fi Book everyone. Download file Free Book PDF Employees How To Save Income Tax Assessment Year 2012 13 2013 14 As Amended By Fi at Complete PDF Library..

How to Save Income Tax for FY 2017-18? Chart Advise. Tax Saving Sections Investments& Expenditure Below is the list of all Tax Saving Sections available for Individuals in India History of Income Tax Slabs in India Section 80C Lots of Options like PPF, ELSS, FD, etc. Section 80CCC Pension Products Section 80CCD Central Government Employee Pension Scheme Maximum Rs 1.5 Lakh Deduction for IncomeTax combining these 3 Sections NPS …, is, it would either tax income when first saved, and not tax the returns (a returns exempt treatment); or it would defer tax on income that is saved, and tax any withdrawals used for consumption (a saving deferred treatment)..

Save Income Tax HDFC Credila

Income Tax Deductions How to Save Tax in India Vakilsearch. Tax savings can be done under Section 80C of the Income Tax Act through equity-linked saving schemes. Investments in these schemes to the extent of Rs.1.5 lakh can be claimed as deductions, and these benefits can be claimed by Indian residents as well as non-resident Indians. In case you earn taxable income from other sources or a house property in India, it makes sense to invest in mutual Save Income Tax With Tax Tables And Investment Planner. Save as PDF credit of Employees How To Save Income Tax With Tax Tables And Investment Planner This site was founded with the idea of offering all the counsel required for all you Employees How To Save Income Tax With Tax Tables And Investment Planner fanatics in order for all to get the most out of their produckt The main target of ….

Torrent Contents. Martin - How to Save 100% on Your Income Tax (expose of IRS bluff)(1992).pdf 100 KB; Please note that this page does not hosts or makes available any of the listed filenames. HOW TO SAVE INCOME TAX PDF READ How To Save Income Tax pdf. Download How To Save Income Tax pdf. Ebooks How To Save Income Tax pdf. Epub How To Save Income Tax pdf.

9/07/2014 · 736 (Income Tax) How to save the Java Filled return in PDF format Video Link - https://www.youtube.com/watch?v=ikrq-... Case AQ - How to download Return in PDF format ? Saving Investments u/s 80C Income Tax Helpline Numbers. EPF/VPF (Employee Provident Fund) The Good •The interest earned on EPF/VPF is Tax Free •Can take loan against EPF and also do partial withdrawal under certain conditions •Convenient to invest as the amount is directly deducted from salary The Bad •Money is locked till your retirement •The EPF interest rates are market linked and

Tax Saving Sections Investments& Expenditure Below is the list of all Tax Saving Sections available for Individuals in India History of Income Tax Slabs in India Section 80C Lots of Options like PPF, ELSS, FD, etc. Section 80CCC Pension Products Section 80CCD Central Government Employee Pension Scheme Maximum Rs 1.5 Lakh Deduction for IncomeTax combining these 3 Sections NPS … Income Tax pdf , Free How To Save Income Tax Through Tax Planning Practical And Time Tested Methods For Saving Income Tax Ebook Download , Free How To Save Income Tax Through Tax Planning Practical And Time Tested Methods For Saving Income Tax Download

after-tax income that allows more future consumption even if one saves a bit less. Consequently, the net effect on current saving can be positive or negative. The issue is further complicated because people with wealth can shift fully taxable assets into a tax-favored retirement account and they do not have to increase saving at all to enjoy a tax break. Some may even borrow in a tax-favored Provisional tax is a way of spreading your tax payments throughout the year. If you have income tax to pay of more than $2,500 from your last income tax year you'll most likely become a provisional tax …

"In this world, nothing can be said to be certain, except death and taxes."- Benjamin Franklin. If you are reading this, you are likely to be someone whose income exceeds the threshold of Rs 2.5 lakhs and falling in the tax paying brackets. Tax Saving Sections Investments& Expenditure Below is the list of all Tax Saving Sections available for Individuals in India History of Income Tax Slabs in India Section 80C Lots of Options like PPF, ELSS, FD, etc. Section 80CCC Pension Products Section 80CCD Central Government Employee Pension Scheme Maximum Rs 1.5 Lakh Deduction for IncomeTax combining these 3 Sections NPS …

The Treasury's 1984 tax plan suggests features of a comprehensive income tax, including the indexation of interest, depreciation, and capital gains. 13 2013 14 AS AMENDED BY FI PDF READ Employees How To Save Income Tax Assessment Year 2012 13 2013 14 As Amended Salaried Employee – Income Tax Saving Tips for Assessment November 17th, 2018 - Income Tax Saving Tips for Assessment Year 2013 14 Financial Year 2012 2013 In India there are various tax slabs for the male and female and as per the annual salary the tax …

9/07/2014 · 736 (Income Tax) How to save the Java Filled return in PDF format Video Link - https://www.youtube.com/watch?v=ikrq-... Case AQ - How to download Return in PDF format ? "In this world, nothing can be said to be certain, except death and taxes."- Benjamin Franklin. If you are reading this, you are likely to be someone whose income exceeds the threshold of Rs 2.5 lakhs and falling in the tax paying brackets.

9/07/2014 · 736 (Income Tax) How to save the Java Filled return in PDF format Video Link - https://www.youtube.com/watch?v=ikrq-... Case AQ - How to download Return in PDF format ? pdf, then you've come to the faithful website. We have The TurboTax 2007 Income Tax Handbook: The Complete Guide to Tax Breaks, Deductions, and Money-Saving Tax Tips (TurboTax Income Tax

Ways to save income tax for salaried employees – U/S 80D (Medical insurance up to Rs 30,000) Many of us take health care insurance / medical insurance, but I feel we never claim the tax … EMPLOYEES HOW TO SAVE INCOME TAX CONTENTS Chapter-heads I-5 1 BASIC CONCEPTS 1.1 Assessment year/previous year 1 1.1-1 Previous year 1 1.2 Residential status and incidence of tax 2 1.2-1 Rule of residence in brief 2 1.2

If you save tax on Rental Income, then it will be icing on the cake. In short, your Net Rental Income will further increase. As the objective of my blog is to benefit readers, therefore, i thought of writing a post on this topic. All the points mentioned are legitimate, and you can save tax on Rental Income. Rental Income – How to save tax on it? (a) Maintenance Charges: To exclude 55 Income Tax Exemptions amp Deductions for Salaried For FY December 7th, 2018 - Comprehensive list of 55 Income Tax Exemptions and Deductions that you can legally use to save Income Tax …

Author camurlidharkhatri Posted on September 12, 2017 September 12, 2017 Categories Income Tax Savings for Salaried Tax Payers, Uncategorized Tags how to save tax for fy 2017-18 pdf, Income Tax, income tax deductions for salaried employees, income tax deductions for salaried employees how to save tax for fy 2017-18 pdf chapter vi a deductions International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 Volume 2, No. 5, May 2013 i-Xplore International Research Journal Consortium www.irjcjournals.org