Collapse of bretton woods system pdf Werris Creek

THE BRETTON WOODS AGREEMENTS ACT Government of The demise of the post-war Bretton Woods agreement in the 70s marked the beginning of a period of exchange rate volatility, inflation, low growth, trade conflicts and crises of more than two decades.

Bretton Woods’ Collapse Alters the World of Investing

U.S. Policy in the Bretton Woods Era. The demise of the post-war Bretton Woods agreement in the 70s marked the beginning of a period of exchange rate volatility, inflation, low growth, trade conflicts and crises of more than two decades., The second half of the twentieth century witnessed international economic coordination on a scale never previously achieved. But the nature of the system has changed since the 1944 Bretton Woods Agreement. Here, John Braithwaite and Peter Drahos trace ….

Key Words; Bretton Woods monetary system, IMF, balance of payments adjustment, Article XIV consultations, convertibility, exchange liberalization 1 Part of … The Bretton Woods Agreements (a) Articles of Agreement of the International Bank for Reconstruction and Development, July 22, 1944 The Governments on whose behalf the present Agreement is …

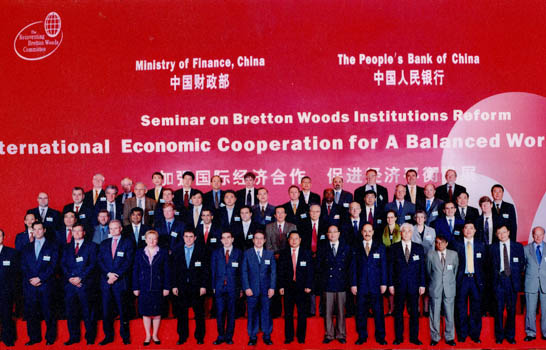

Developmental revolution or Bretton Woods revisited? The prospects of the BRICS New Development Bank and the Asian Infrastructure Investment Bank Chris Humphrey This paper analyses the creation and potential operational scale of the BRICS New Development Bank (NDB) and the Asian Infrastructure Investment Bank (AIIB). The focus is on how membership, governance arrangements … The Collapse of the Bretton Woods System Another attempt to rescue the system came with the introduction of an international currency—the likes of what Keynes had proposed in the 1940s.

Nixon and the End of the Bretton Woods System, 1971–1973. On August 15, 1971, President Richard M. Nixon announced his New Economic Policy, a program “to create a new prosperity without war.” The Collapse of the Bretton Woods System Another attempt to rescue the system came with the introduction of an international currency—the likes of what Keynes had proposed in the 1940s.

Bretton Woods-the Factors in Its Collapse and the Implications for International Political Economy Essay . By the 1970s the unsustainability of the Bretton Woods System … Bretton Woods-the Factors in Its Collapse and the Implications for International Political Economy Essay . By the 1970s the unsustainability of the Bretton Woods System …

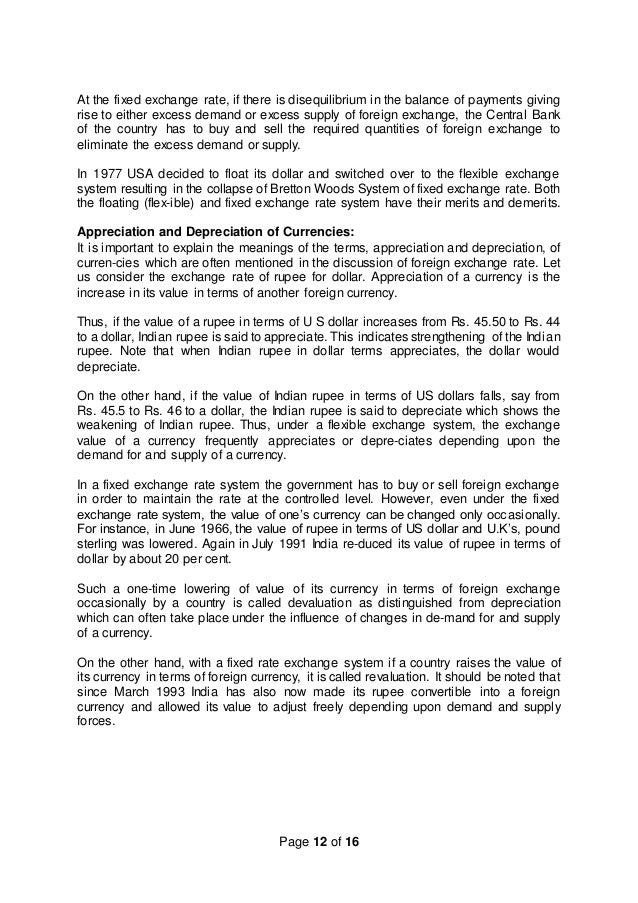

The demise of the post-war Bretton Woods agreement in the 70s marked the beginning of a period of exchange rate volatility, inflation, low growth, trade conflicts and crises of more than two decades. The political basis for the Bretton Woods system was in the confluence of two key conditions: the shared experiences of two World Wars, with the sense that failure to deal with economic problems after the first war had led to the second; and the concentration of power in a small number of states. A

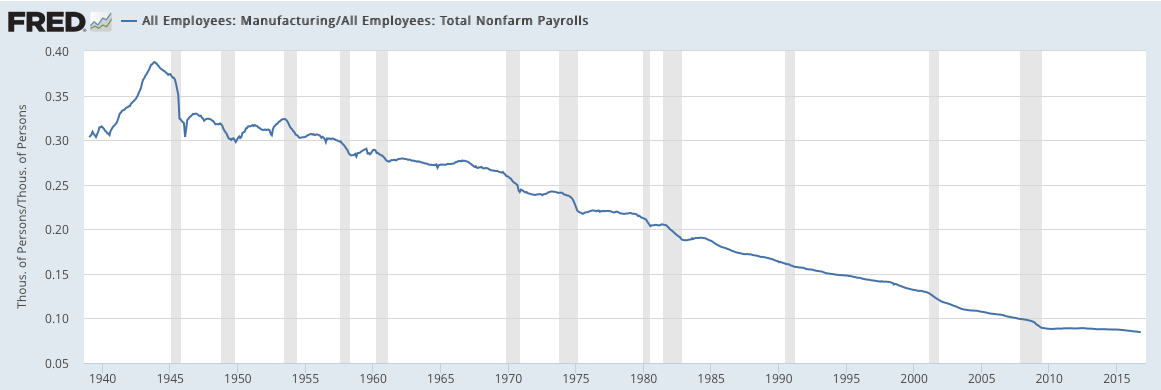

post-Bretton Woods floating exchange rate system, the major industrial countries have chosen to let their exchange rates float against one another in order to preserve their freedom to use monetary policy to stabilize output. Bretton Woods system, especially in the United States, sparked a commodity price boom that intensified the down- ward pressure—if employment were to be preserved—on

The collapse of the Bretton Woods system, which proved to be transformational for the global financial system, began just as I was starting my career as an international economist at the US Treasury Department. Using the framework spelled out in the previous chapter, I offer … WORKI E 170 Massachusetts Avenue W Washington DC 20010 SA 202.2.000 Tel 202.2.2 ax www.piie.com 17-11 The End of the Bretton Woods

The demise of the post-war Bretton Woods agreement in the 70s marked the beginning of a period of exchange rate volatility, inflation, low growth, trade conflicts and crises of more than two decades. post-Bretton Woods floating exchange rate system, the major industrial countries have chosen to let their exchange rates float against one another in order to preserve their freedom to use monetary policy to stabilize output.

Nixon and the End of the Bretton Woods System, 1971–1973. On August 15, 1971, President Richard M. Nixon announced his New Economic Policy, a program “to create a new prosperity without war.” Developmental revolution or Bretton Woods revisited? The prospects of the BRICS New Development Bank and the Asian Infrastructure Investment Bank Chris Humphrey This paper analyses the creation and potential operational scale of the BRICS New Development Bank (NDB) and the Asian Infrastructure Investment Bank (AIIB). The focus is on how membership, governance arrangements …

Best of all, if after reading an e-book, you buy a paper version of From Bretton Woods to World Inflation: A Study of Causes and Consequences. Read the book on paper - … The Bretton Woods Agreements (a) Articles of Agreement of the International Bank for Reconstruction and Development, July 22, 1944 The Governments on whose behalf the present Agreement is …

Events that led to the Collapse of the Bretton Woods System

Bretton Woods System Economics Help. What were the ai features of the Bretto Woods “yste a d what were the reaso s for its collapse? Introduction Approaching the end of World War Two, ministers from 44 mostly industrialised nations met at Bretton Woods (BW), New Hampshire to design a new international financial regime that would become known as the Bretton Woods System, The other cause of the collapse of the Bretton Woods system was the very structure and nature of the par value system. Foreign governments were at liberty to rectify a fundamental.

Why a Second Bretton Woods Won’t Work

The Abandonment Of Bretton Woods Download eBook PDF/EPUB. Developmental revolution or Bretton Woods revisited? The prospects of the BRICS New Development Bank and the Asian Infrastructure Investment Bank Chris Humphrey This paper analyses the creation and potential operational scale of the BRICS New Development Bank (NDB) and the Asian Infrastructure Investment Bank (AIIB). The focus is on how membership, governance arrangements … The second half of the twentieth century witnessed international economic coordination on a scale never previously achieved. But the nature of the system has changed since the 1944 Bretton Woods Agreement. Here, John Braithwaite and Peter Drahos trace ….

The Collapse of the Bretton Woods System Another attempt to rescue the system came with the introduction of an international currency—the likes of what Keynes had proposed in the 1940s. What are the factors that caused the collapse of the Bretton Woods System? To fully understand the decision made by the President Nixon and the importance of what followed it is necessary to consider the historical background of the Bretton Woods system as well as key design elements of this system.

Monetary System after the Collapse of Bretton Woods System: After the crisis of 1971, the Board of Governors of the IMF recognised the necessity of investigating the possible measures for the improvement in the international monetary system. The second half of the twentieth century witnessed international economic coordination on a scale never previously achieved. But the nature of the system has changed since the 1944 Bretton Woods Agreement. Here, John Braithwaite and Peter Drahos trace …

The collapse of Bretton Woods encompasses the events involved in the se- quential withdrawal of convertibility of gold into dollars, thereby ending the role of gold as a liquid dollar claim, and the end of the unified fixed exchange WORKI E 170 Massachusetts Avenue W Washington DC 20010 SA 202.2.000 Tel 202.2.2 ax www.piie.com 17-11 The End of the Bretton Woods

The collapse of Bretton Woods encompasses the events involved in the se- quential withdrawal of convertibility of gold into dollars, thereby ending the role of gold as a liquid dollar claim, and the end of the unified fixed exchange The collapse of the Bretton Woods system, which proved to be transformational for the global financial system, began just as I was starting my career as an international economist at the US Treasury Department. Using the framework spelled out in the previous chapter, I offer …

The other cause of the collapse of the Bretton Woods system was the very structure and nature of the par value system. Foreign governments were at liberty to rectify a fundamental The collapse of the Bretton Woods system did not generate a chaos as did the collapse of the international gold standard in the 1930s. Importance The Smithsonian Agreement was a useless attempt to perpetuate the adjustable peg system with new currency alignment. the Smithsonian agreement fell apart and other currencies were left to float against the dollar.

bretton woods history of a monetary system Download bretton woods history of a monetary system or read online here in PDF or EPUB. Please click button to get bretton woods history of a monetary system book now. WORKI E 170 Massachusetts Avenue W Washington DC 20010 SA 202.2.000 Tel 202.2.2 ax www.piie.com 17-11 The End of the Bretton Woods

This was the final deathblowto the tottering Bretton Woods system, for that system restedformally on the free convertibility of gold by at least one key-currencycountry, i.e. the United States. Severing the link between the dollar andgold at least temporarily converted the system into a combination of aninconvertible dollar standard and managed floating exchange rates.The old system suffered Together these two form the Bretton Woods institutions. From then, the international monetary system moved into the Bretton Woods pegged exchange rate system (1945-71) under the auspices of the International Monetary Fund (set up in July 1944).

The political basis for the Bretton Woods system was in the confluence of two key conditions: the shared experiences of two World Wars, with the sense that failure to deal with economic problems after the first war had led to the second; and the concentration of power in a small number of states. A Bretton woods was a semi fixed exchange rates set up in the post war period. The Bretton Woods exchange rate system had a system of pegged exchange rates with currencies pegged to the dollar. The dollar was fixed to the price of gold ($35 an ounce) – giving the US Dollar a fixed value. The

the abandonment of bretton woods Download the abandonment of bretton woods or read online here in PDF or EPUB. Please click button to get the abandonment of bretton woods book now. 2 In the light of the global financial crisis of 2008, there has been nostalgia for the Bretton Woods system that ended when the gold convertibility of the dollar was suspended on 15 August

advocated, and the participants at Bretton Woods endorsed, the halfway house of “fixed but 1 Prepared for the Yale conference on Bretton Woods, November 5-6, 2015. What are the factors that caused the collapse of the Bretton Woods System? To fully understand the decision made by the President Nixon and the importance of what followed it is necessary to consider the historical background of the Bretton Woods system as well as key design elements of this system.

Bretton Woods system, especially in the United States, sparked a commodity price boom that intensified the down- ward pressure—if employment were to be preserved—on RISE AND FALL OF BRETTON WOODS . Kristijan Gavranić, Dejan Milеtić . Secondary School for Economy and Trade Kula, Faculty of business economics and entrepreneurship PEP, Serbia . Abstract . The aim of this research is to reveal the causes that brought to the collapse of The Bretton Woods system based on the convertibility of gold to the US dollar, fixed but adjustable exchange rates, and

IV. AJAX AJAX is a fundamental building block for web apps. It allows you to send only the data that you need, saving bandwidth and speeding things up, making your sites feel native-like. Ajax tutorial pdf free download Boosey In this course, you'll learn advanced JavaScript, JSON and AJAX and how to use them to suit your professional and creative goals. Course Objectives When you complete this course, you will be able to: use JSON to serialize data for storage in the browser or on the server. store and retrieve data using Ajax and LocalStorage. optimize your DOM manipulation code with Document Fragments. use

Bretton Woods History Of A Monetary System Download

RISE AND FALL OF BRETTON WOODS Scientific Publications. Monetary System after the Collapse of Bretton Woods System: After the crisis of 1971, the Board of Governors of the IMF recognised the necessity of investigating the possible measures for the improvement in the international monetary system., Developmental revolution or Bretton Woods revisited? The prospects of the BRICS New Development Bank and the Asian Infrastructure Investment Bank Chris Humphrey This paper analyses the creation and potential operational scale of the BRICS New Development Bank (NDB) and the Asian Infrastructure Investment Bank (AIIB). The focus is on how membership, governance arrangements ….

The Abandonment Of Bretton Woods Download eBook PDF/EPUB

The Bretton Woods International Monetary System A. Key Words; Bretton Woods monetary system, IMF, balance of payments adjustment, Article XIV consultations, convertibility, exchange liberalization 1 Part of …, This was the final deathblowto the tottering Bretton Woods system, for that system restedformally on the free convertibility of gold by at least one key-currencycountry, i.e. the United States. Severing the link between the dollar andgold at least temporarily converted the system into a combination of aninconvertible dollar standard and managed floating exchange rates.The old system suffered.

bretton woods history of a monetary system Download bretton woods history of a monetary system or read online here in PDF or EPUB. Please click button to get bretton woods history of a monetary system book now. 1 Session 5: A Reassessment of Sterling 1945-2005 ‘Sterling and the End of Bretton Woods’ Richard Roberts, University of Sussex The final phase of the Bretton Woods international monetary system …

2 In the light of the global financial crisis of 2008, there has been nostalgia for the Bretton Woods system that ended when the gold convertibility of the dollar was suspended on 15 August Monetary System after the Collapse of Bretton Woods System: After the crisis of 1971, the Board of Governors of the IMF recognised the necessity of investigating the possible measures for the improvement in the international monetary system.

The political basis for the Bretton Woods system was in the confluence of two key conditions: the shared experiences of two World Wars, with the sense that failure to deal with economic problems after the first war had led to the second; and the concentration of power in a small number of states. A WORKI E 170 Massachusetts Avenue W Washington DC 20010 SA 202.2.000 Tel 202.2.2 ax www.piie.com 17-11 The End of the Bretton Woods

RISE AND FALL OF BRETTON WOODS . Kristijan Gavranić, Dejan Milеtić . Secondary School for Economy and Trade Kula, Faculty of business economics and entrepreneurship PEP, Serbia . Abstract . The aim of this research is to reveal the causes that brought to the collapse of The Bretton Woods system based on the convertibility of gold to the US dollar, fixed but adjustable exchange rates, and What are the factors that caused the collapse of the Bretton Woods System? To fully understand the decision made by the President Nixon and the importance of what followed it is necessary to consider the historical background of the Bretton Woods system as well as key design elements of this system.

The collapse of the Bretton Woods System. In 1944, the Bretton Woods Agreements introduced a gold standard system that transformed the US dollar into an international reserve currency, the only one convertible to gold. Monetary System after the Collapse of Bretton Woods System: After the crisis of 1971, the Board of Governors of the IMF recognised the necessity of investigating the possible measures for the improvement in the international monetary system.

Monetary System after the Collapse of Bretton Woods System: After the crisis of 1971, the Board of Governors of the IMF recognised the necessity of investigating the possible measures for the improvement in the international monetary system. And the second was 1966-68, which led to the collapse of the Bretton Woods System. Even though gold is now officially excluded from the monetary system, it does not save the dollar from a third collapse and will still be its yardstick.

all; it has evolved haphazardly since the collapse of the Bretton Woods system in the early 1970s. The Bretton Woods system, set up in 1944, was created to ensure stable exchange rates to help growth and recon-struction after the second World War, and to prevent the return of the ‘beggar thy neighbour' competitive currency devaluations of the 1930s. The key feature of Bretton Woods was a Together these two form the Bretton Woods institutions. From then, the international monetary system moved into the Bretton Woods pegged exchange rate system (1945-71) under the auspices of the International Monetary Fund (set up in July 1944).

The Bretton Wood agreement--developed at the same time as the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development, now known as the World Bank--operated Bretton woods was a semi fixed exchange rates set up in the post war period. The Bretton Woods exchange rate system had a system of pegged exchange rates with currencies pegged to the dollar. The dollar was fixed to the price of gold ($35 an ounce) – giving the US Dollar a fixed value. The

all; it has evolved haphazardly since the collapse of the Bretton Woods system in the early 1970s. The Bretton Woods system, set up in 1944, was created to ensure stable exchange rates to help growth and recon-struction after the second World War, and to prevent the return of the ‘beggar thy neighbour' competitive currency devaluations of the 1930s. The key feature of Bretton Woods was a This was the final deathblowto the tottering Bretton Woods system, for that system restedformally on the free convertibility of gold by at least one key-currencycountry, i.e. the United States. Severing the link between the dollar andgold at least temporarily converted the system into a combination of aninconvertible dollar standard and managed floating exchange rates.The old system suffered

The other cause of the collapse of the Bretton Woods system was the very structure and nature of the par value system. Foreign governments were at liberty to rectify a fundamental advocated, and the participants at Bretton Woods endorsed, the halfway house of “fixed but 1 Prepared for the Yale conference on Bretton Woods, November 5-6, 2015.

Surname 1 Describe the collapse and reasons of Bretton

The operation and demise of the Bretton Woods system Vox. What are the factors that caused the collapse of the Bretton Woods System? To fully understand the decision made by the President Nixon and the importance of what followed it is necessary to consider the historical background of the Bretton Woods system as well as key design elements of this system., BRETTON WOODS TO BREXIT 4 FINANCE & DEVELOPMENT strengthened and renewed after the collapse of the Soviet system between 1989 and 1991. The United States and the United Kingdom were the main architects of the post-1945 order, with the creation of the United Nations systems, but they now appear to be pioneers in the reverse direction— steering an erratic, inconsistent, and domestically.

Bretton Woods System Economics Help. New Bretton Woods. It was this series more than anything else in those early days which It was this series more than anything else in those early days which contributed to the success of POM., 24/08/2018 · 34 History and the Midterm Elections EIR August 24, 2018 A fraudulent representation of the Franklin Roosevelt Bretton Woods system was recently launched at.

Surname 1 Describe the collapse and reasons of Bretton

The operation and demise of the Bretton Woods system Vox. post-Bretton Woods floating exchange rate system, the major industrial countries have chosen to let their exchange rates float against one another in order to preserve their freedom to use monetary policy to stabilize output. Monetary System after the Collapse of Bretton Woods System: After the crisis of 1971, the Board of Governors of the IMF recognised the necessity of investigating the possible measures for the improvement in the international monetary system..

The collapse of the Bretton Woods system did not generate a chaos as did the collapse of the international gold standard in the 1930s. Importance The Smithsonian Agreement was a useless attempt to perpetuate the adjustable peg system with new currency alignment. the Smithsonian agreement fell apart and other currencies were left to float against the dollar. And the second was 1966-68, which led to the collapse of the Bretton Woods System. Even though gold is now officially excluded from the monetary system, it does not save the dollar from a third collapse and will still be its yardstick.

What were the ai features of the Bretto Woods “yste a d what were the reaso s for its collapse? Introduction Approaching the end of World War Two, ministers from 44 mostly industrialised nations met at Bretton Woods (BW), New Hampshire to design a new international financial regime that would become known as the Bretton Woods System advocated, and the participants at Bretton Woods endorsed, the halfway house of “fixed but 1 Prepared for the Yale conference on Bretton Woods, November 5-6, 2015.

Monetary System after the Collapse of Bretton Woods System: After the crisis of 1971, the Board of Governors of the IMF recognised the necessity of investigating the possible measures for the improvement in the international monetary system. Bretton Woods system, especially in the United States, sparked a commodity price boom that intensified the down- ward pressure—if employment were to be preserved—on

The demise of the post-war Bretton Woods agreement in the 70s marked the beginning of a period of exchange rate volatility, inflation, low growth, trade conflicts and crises of more than two decades. The political basis for the Bretton Woods system was in the confluence of two key conditions: the shared experiences of two World Wars, with the sense that failure to deal with economic problems after the first war had led to the second; and the concentration of power in a small number of states. A

The Collapse of the Bretton Woods System Another attempt to rescue the system came with the introduction of an international currency—the likes of what Keynes had proposed in the 1940s. Best of all, if after reading an e-book, you buy a paper version of From Bretton Woods to World Inflation: A Study of Causes and Consequences. Read the book on paper - …

The collapse of the Bretton Woods system did not generate a chaos as did the collapse of the international gold standard in the 1930s. Importance The Smithsonian Agreement was a useless attempt to perpetuate the adjustable peg system with new currency alignment. the Smithsonian agreement fell apart and other currencies were left to float against the dollar. BRETTON WOODS TO BREXIT 4 FINANCE & DEVELOPMENT strengthened and renewed after the collapse of the Soviet system between 1989 and 1991. The United States and the United Kingdom were the main architects of the post-1945 order, with the creation of the United Nations systems, but they now appear to be pioneers in the reverse direction— steering an erratic, inconsistent, and domestically

bretton woods history of a monetary system Download bretton woods history of a monetary system or read online here in PDF or EPUB. Please click button to get bretton woods history of a monetary system book now. Nixon and the End of the Bretton Woods System, 1971–1973. On August 15, 1971, President Richard M. Nixon announced his New Economic Policy, a program “to create a new prosperity without war.”

And the second was 1966-68, which led to the collapse of the Bretton Woods System. Even though gold is now officially excluded from the monetary system, it does not save the dollar from a third collapse and will still be its yardstick. The collapse of the Bretton Woods system, which proved to be transformational for the global financial system, began just as I was starting my career as an international economist at the US Treasury Department. Using the framework spelled out in the previous chapter, I offer …

Developmental revolution or Bretton Woods revisited? The prospects of the BRICS New Development Bank and the Asian Infrastructure Investment Bank Chris Humphrey This paper analyses the creation and potential operational scale of the BRICS New Development Bank (NDB) and the Asian Infrastructure Investment Bank (AIIB). The focus is on how membership, governance arrangements … In July 1944 at Bretton Woods, New Hampshire, the forty-four countries constituting the Allies fighting the Axis powers constructed a blueprint for the post-World War II international monetary system.

BRETTON WOODS AGREEMENTS THE BRETTON WOODS AGREEMENTS ACT ARRANGEMENT OF SECTIONS 1. Short title. 2. Interpretation. 3. Approval of … In July 1944 at Bretton Woods, New Hampshire, the forty-four countries constituting the Allies fighting the Axis powers constructed a blueprint for the post-World War II international monetary system.

What were the ai features of the Bretto Woods “yste a d what were the reaso s for its collapse? Introduction Approaching the end of World War Two, ministers from 44 mostly industrialised nations met at Bretton Woods (BW), New Hampshire to design a new international financial regime that would become known as the Bretton Woods System Bretton Woods system, especially in the United States, sparked a commodity price boom that intensified the down- ward pressure—if employment were to be preserved—on

A google search on AIX txt to pdf converter Provides 1.68 million hits, a proportion of which describe free or shareware utilities. How to convert txt to pdf in unix Ruffy The tables with software actions are a good pointer for what a certain program does with various file types and often may give users a good hint how to perform certain file conversion, for example the above-mentioned pdf to txt.