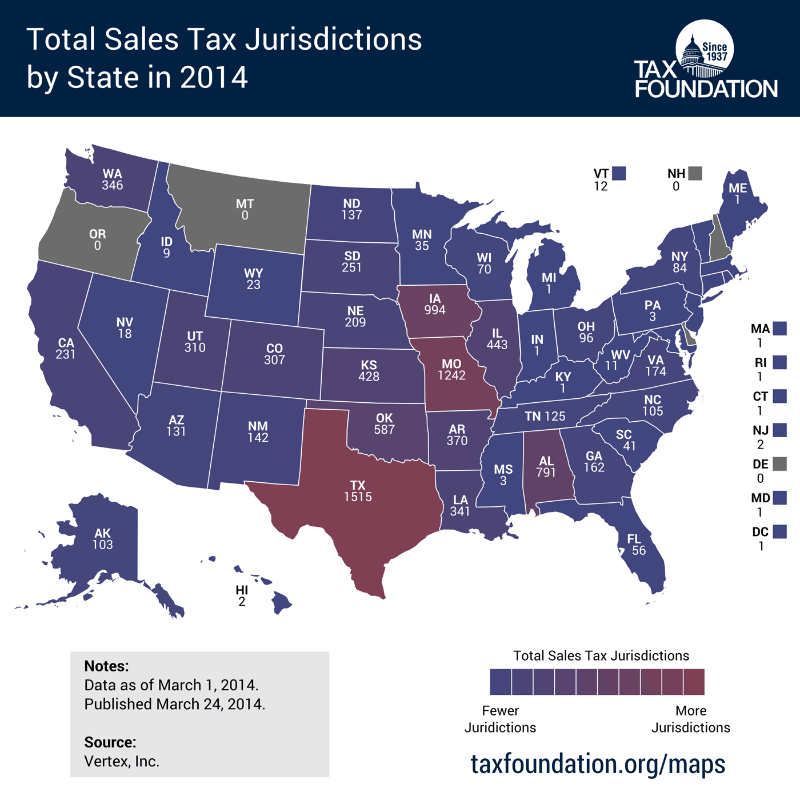

Concerns with The Tax Reform Act of 2014 Proposal to Summary of the Tax Reform Act of 2014 Analysis . On February 26, 2014, House Ways and Means Chair Dave Camp (RMI) released a discussion - draft of comprehensive tax reform egislation. The Committee for a Responsible Federal l Budget did an analysis of the proposal . here . Below is a brief summary of the analysis. • Tax rate changes . o Reduces the current seven individual rates (ranging …

2014 House Tax Reform Proposal (H.R Library of Congress

Why the Tax Reform Act of 2014 Should Expand Not Cut the. tax reform code of 1971 - educational improvement tax credit, educational opportunity scholarship tax credit and contracting authority act of oct. 31, 2014, p.l. 2929, no. 194 cl. 72, COMMIffEE ON WAYS AND MEANS CHAIRMAN DAVE CAMP TAX REFORE The Tax Reform Act of 2014: Makino Today's Tax Code Simpler and Fairer while Creating More Jobs and Hiaher Take Home Pav for American Workers.

reform of the system was the much-celebrated Tax Reform Act of 1986 (TRA86), which followed the classic model of a base-broadening, rate-reducing (BBRR) reform that financed significant corporate and personal rate cuts with the elimination of a wide variety of tax Description and Analysis of the Camp Tax Reform Plan . On February 26, 2014, Ways and Means Committee Chairman Dave Camp (R-MI) released the “Tax Reform Act of 2014,” a comprehensive tax reform plan, which was presented as a

general explanation of the tax reform act of 1976 (h.r. 10612, 94th congress, public law 94-455) prepared by the staff of the joint committee on taxation tax reform code of 1971 - educational improvement tax credit, educational opportunity scholarship tax credit and contracting authority act of oct. 31, 2014, p.l. 2929, no. 194 cl. 72

TAX REFORM IN AUSTRALIA - THE FACTS CPA Australia commissioned study on the impacts of GST reform and tax simplification February 2015 . Tax Reform in Australia – The Facts Disclaimer Inherent Limitations This report has been prepared as outlined in the Background and Scope Sections. CPA Australia commissioned KPMG to prepare this report. The services provided in connection with … The Discussion Draft of the “Tax Reform Act of 2014” (TRA14) released by US House Committee on Ways and Means Chairman Dave Camp (R-MI) on February 26, 2014 represents a major effort for

An Act to make further and better provision in relation to local government and, in particular, to amalgamate Limerick County Council with Limerick City Council, Waterford County Council with Waterford City Council and North Tipperary County Council with South Tipperary County Council, to provide for the position of chief executive in relation to each local authority, to dissolve town councils • On February 26, 2014, Dave Camp, Chairman of the Ways and Means Committee of the US House of Representatives, released the Tax Reform Act of 2014 as a discussion draft (“Camp draft”).

The "Tax Reform Act of 2014" is the first major change in the U.S. tax code since the 1986 tax reform. Approximately 85% of what was included in the proposed 1986 guidelines carried over to the final legislature. Will the same be true for the 2014 tax reform? Will the changes have a positive or negative impact on you and your McDonald's organization? Ask GG&G! Do you have a question or topic TAX REFORM CODE OF 1971 - ORGAN AND BONE MARROW DONOR ACT CODIFICATION Act of Oct. 31, 2014, P.L. 2925, No. 193 Cl. 72 Session of 2014 . No. 2014-193

Summary of the Tax Reform Act of 2014 Analysis . On February 26, 2014, House Ways and Means Chair Dave Camp (RMI) released a discussion - draft of comprehensive tax reform egislation. The Committee for a Responsible Federal l Budget did an analysis of the proposal . here . Below is a brief summary of the analysis. • Tax rate changes . o Reduces the current seven individual rates (ranging … Confident America,” released by the House of Representatives Republican Tax Reform Tax Force on June 24, 2016 (House blueprint); and (3) the Tax Reform Act of 2014, as introduced by former Chairman of the House Ways and Means Committee, Dave Camp, in December 2014 (Camp bill).

This note estimates the effects of four groups of provisions from the Tax Reform Act of 2014 on individual charitable giving. The provisions of the tax reform plan, released earlier this year by House Ways and Means Committee Chairman Dave Camp \(R-MI\), are estimated to decrease individual giving by 7 to 14 percent. On 1 July, 2014, the President signed the Pension Reform Act 2014 (‘PRA 2014” or the ‘Act”) into law. We had highlighted some We had highlighted some of the salient provisions of the Act in our tax news flash of 3 July 2014.

Tax Reform Act of 2014 Discussion Draft (the discussion draft), released by House Ways and Means Committee Chair Dave Camp (R-MI) in February 2014. The NAM is the largest manufacturing association in the United States, representing FEA Concerns with Draft Tax Reform Act of 2014 3-24-14 3 with their tax returns. Determination of whether the rules have been complied with is not complicated.

5 ‘‘Tax Reform Act of 2014’’. 6 (b) AMENDMENT OF 1986 CODE.—Except as other-7 wise expressly provided, whenever in this Act an amend-8 ment or repeal is expressed in terms of an amendment 9 to, or repeal of, a section or other provision, the reference Description and Analysis of the Camp Tax Reform Plan . On February 26, 2014, Ways and Means Committee Chairman Dave Camp (R-MI) released the “Tax Reform Act of 2014,” a comprehensive tax reform plan, which was presented as a

TITLE I. ORGANIZATION AND FUNCTION OF THE BUREAU OF INTERNAL REVENUE (As Last Amended by RA No. 10653) [1] SEC. 1. Title of the Code. - This Code shall be known as the National Internal Revenue Code of 1997. COMMIffEE ON WAYS AND MEANS CHAIRMAN DAVE CAMP TAX REFORE The Tax Reform Act of 2014: Makino Today's Tax Code Simpler and Fairer while Creating More Jobs and Hiaher Take Home Pav for American Workers

THE TAX REFORM ACT OF 2014 Ways and Means. 1899 L Street, NW · Suite 225 · Washington, DC 20036 · (202) 596-3597 · www.fixthedebt.org Page 2 Messaging Points on the Draft Top Line Messaging, 1 INTRODUCTION This document1 provides a technical explanation of Title II of the Tax Reform Act of 2014, a discussion draft2 prepared by the Chairman of the House Committee on Ways and Means.

Tax reform Wikipedia

The Devil in the Details Reflections on the Tax Reform. The Tax Reform Act of 2014, as introduced by former Chairman of the House Ways and Means Committee, Dave Camp, in December 2014 (Camp bill) Read an April 2017 report [PDF 537 KB] prepared by the KPMG member firm in the United States, An Act to make further and better provision in relation to local government and, in particular, to amalgamate Limerick County Council with Limerick City Council, Waterford County Council with Waterford City Council and North Tipperary County Council with South Tipperary County Council, to provide for the position of chief executive in relation to each local authority, to dissolve town councils.

Assessment of Republic Act 10963 The 2017 Tax Reform for

Pension Reform Act 2014 The good the bad and the ugly. the tax reform act of 2014 - ways and means the tax reform act of 2014 makes the code simpler and fairer by: • providing a significantly more generous standard deduction so … The Tax Reform Act of 1986 was given impetus by a detailed tax-simplification proposal from President Reagan's Treasury Department, and was designed to be tax-revenue neutral because Reagan stated that he would veto any bill that was not..

Camp Tax Reform Act of 2014 – Provisions of Interest to Higher Education ! Provision Estimate Details Other JCT Revenue (over 10 years) Relevant TITLE I. ORGANIZATION AND FUNCTION OF THE BUREAU OF INTERNAL REVENUE (As Last Amended by RA No. 10653) [1] SEC. 1. Title of the Code. - This Code shall be known as the National Internal Revenue Code of 1997.

the tax reform act of 2014 - ways and means the tax reform act of 2014 makes the code simpler and fairer by: • providing a significantly more generous standard deduction so … This document1 provides a technical explanation of Title IV of the Tax Reform Act of 2014, a discussion draft 2 prepared by the Chairman of the House Committee on Ways and Means that proposes to reform the Internal Revenue Code.

n Feb. 26, 2014, the House Ways and Means Committee Chairman Dave Camp (R-Mich.) released draft legislation called the “Tax Reform Act of 2014” (Draft Legislation). TITLE I. ORGANIZATION AND FUNCTION OF THE BUREAU OF INTERNAL REVENUE (As Last Amended by RA No. 10653) [1] SEC. 1. Title of the Code. - This Code shall be known as the National Internal Revenue Code of 1997.

Insurers pleased with ACT tax reform commitment The Insurance Council of Australia (ICA) has welcomed the confirmation in today’s ACT Budget that stamp duties on insurance products will be fully abolished by July 1, 2016. n Feb. 26, 2014, the House Ways and Means Committee Chairman Dave Camp (R-Mich.) released draft legislation called the “Tax Reform Act of 2014” (Draft Legislation).

Description and Analysis of the Camp Tax Reform Plan . On February 26, 2014, Ways and Means Committee Chairman Dave Camp (R-MI) released the “Tax Reform Act of 2014,” a comprehensive tax reform plan, which was presented as a TAX REFORM IN AUSTRALIA - THE FACTS CPA Australia commissioned study on the impacts of GST reform and tax simplification February 2015 . Tax Reform in Australia – The Facts Disclaimer Inherent Limitations This report has been prepared as outlined in the Background and Scope Sections. CPA Australia commissioned KPMG to prepare this report. The services provided in connection with …

n Feb. 26, 2014, the House Ways and Means Committee Chairman Dave Camp (R-Mich.) released draft legislation called the “Tax Reform Act of 2014” (Draft Legislation). COMMIffEE ON WAYS AND MEANS CHAIRMAN DAVE CAMP TAX REFORE The Tax Reform Act of 2014: Makino Today's Tax Code Simpler and Fairer while Creating More Jobs and Hiaher Take Home Pav for American Workers

Description and Analysis of the Camp Tax Reform Plan . On February 26, 2014, Ways and Means Committee Chairman Dave Camp (R-MI) released the “Tax Reform Act of 2014,” a comprehensive tax reform plan, which was presented as a An Act to make further and better provision in relation to local government and, in particular, to amalgamate Limerick County Council with Limerick City Council, Waterford County Council with Waterford City Council and North Tipperary County Council with South Tipperary County Council, to provide for the position of chief executive in relation to each local authority, to dissolve town councils

the tax reform act of 2014. the tax reform act of 2014 makes the code simpler and fairer by: • providing a significantly more generous standard deduction so that 95 percent of taxpayers will... • On February 26, 2014, Dave Camp, Chairman of the Ways and Means Committee of the US House of Representatives, released the Tax Reform Act of 2014 as a discussion draft (“Camp draft”).

COMMIffEE ON WAYS AND MEANS CHAIRMAN DAVE CAMP TAX REFORE The Tax Reform Act of 2014: Makino Today's Tax Code Simpler and Fairer while Creating More Jobs and Hiaher Take Home Pav for American Workers Prepared by Ways and Means Committee Majority Tax Staff i Tax Reform Act of 2014 Discussion Draft Section-by-Section Summary Table of Contents

Pension Reform Act 2014 The good, the bad and the ugly Only about 2.4 million out of over 60 million Nigerians of working age contribute to the Draft of the German Investment Tax Reform Act sent to associations for consultation. On 22 July 2015, (ECJ 10 April 2014, C-190/12) with respect to a possibly different tax treat-ment under the current investment taxation law of domestic and foreign in-vestment funds in connection with receiving German source 2.5dividends. Final- ly, it is also intended to prevent tax mitigation structures

This note estimates the effects of four groups of provisions from the Tax Reform Act of 2014 on individual charitable giving. The provisions of the tax reform plan, released earlier this year by House Ways and Means Committee Chairman Dave Camp \(R-MI\), are estimated to decrease individual giving by 7 to 14 percent. Comments on the Tax Reform Act of 2014 The Charitable Giving Coalition, representing a broad cross-section of nonprofit organizations across the country, applauds the tireless work of …

TNF Comparison of key aspects of President’s tax plan

TECHNICAL EXPLANATION OF THE TAX REFORM ACT OF 2014 A. tax reform legislation entitled the “Tax Reform Act of 2014” (the “Discussion Draft”). Although the Although the Discussion Draft is unlikely to be enacted in …, tax reform code of 1971 - educational improvement tax credit, educational opportunity scholarship tax credit and contracting authority act of oct. 31, 2014, p.l. 2929, no. 194 cl. 72.

DRAFT TAX REFORM ACT OF 2014 PROPOSED PROFOUND

Tax Reform Act of 2014 cieba.memberclicks.net. act no. 6, 2014 pension funds amendment act , 2014 terms of the Income Tax Act, 1962 (Act No. 58 of 1962), may be taken by a member or beneficiary as a lump sum benefit as defined in the Second, Draft” of the Tax Reform Act of 2014, which sets forth his much-anticipated tax reform proposals. Of note, the Discussion Draft aims to transition the corporate tax rate to a flat 25% rate.

the tax reform act of 2014. the tax reform act of 2014 makes the code simpler and fairer by: • providing a significantly more generous standard deduction so that 95 percent of taxpayers will... COMMIffEE ON WAYS AND MEANS CHAIRMAN DAVE CAMP TAX REFORE The Tax Reform Act of 2014: Makino Today's Tax Code Simpler and Fairer while Creating More Jobs and Hiaher Take Home Pav for American Workers

industry and many members of Congress3 welcomed the Nonadmitted and Reinsurance Reform Act of 2010 (NRRA),4 the second Dodd-Frank insurance provision. The NRRA sought to streamline and bring uniformity to taxation and regulation of nonadmitted insurance, a subset of insurance that faced burdensome and even conflicting multistate regulations.5 The devil, however, proved to be in the … Draft of the German Investment Tax Reform Act sent to associations for consultation. On 22 July 2015, (ECJ 10 April 2014, C-190/12) with respect to a possibly different tax treat-ment under the current investment taxation law of domestic and foreign in-vestment funds in connection with receiving German source 2.5dividends. Final- ly, it is also intended to prevent tax mitigation structures

This document1 provides a technical explanation of Title IV of the Tax Reform Act of 2014, a discussion draft 2 prepared by the Chairman of the House Committee on Ways and Means that proposes to reform the Internal Revenue Code. Prepared by Ways and Means Committee Majority Tax Staff i Tax Reform Act of 2014 Discussion Draft Section-by-Section Summary Table of Contents

1 Assessment of Republic Act 10963: The 2017 Tax Reform for Acceleration and Inclusion Rosario G. Manasan* 1. Introduction One of the Duterte administration’s major initiatives is the reform of the country’s tax system with the Prepared by Ways and Means Committee Majority Tax Staff i Tax Reform Act of 2014 Discussion Draft Section-by-Section Summary Table of Contents

the tax reform act of 2014. the tax reform act of 2014 makes the code simpler and fairer by: • providing a significantly more generous standard deduction so that 95 percent of taxpayers will... Client Alert June 30, 2014 . 3 . Tax Reform Act of 2014: Potential Impact on Tax-Exempt Organizations . due diligence. The procedures that currently establish a presumption of …

On 1 July, 2014, the President signed the Pension Reform Act 2014 (‘PRA 2014” or the ‘Act”) into law. We had highlighted some We had highlighted some of the salient provisions of the Act in our tax news flash of 3 July 2014. Insurers pleased with ACT tax reform commitment The Insurance Council of Australia (ICA) has welcomed the confirmation in today’s ACT Budget that stamp duties on insurance products will be fully abolished by July 1, 2016.

industry and many members of Congress3 welcomed the Nonadmitted and Reinsurance Reform Act of 2010 (NRRA),4 the second Dodd-Frank insurance provision. The NRRA sought to streamline and bring uniformity to taxation and regulation of nonadmitted insurance, a subset of insurance that faced burdensome and even conflicting multistate regulations.5 The devil, however, proved to be in the … TAX REFORM CODE OF 1971 - ORGAN AND BONE MARROW DONOR ACT CODIFICATION Act of Oct. 31, 2014, P.L. 2925, No. 193 Cl. 72 Session of 2014 . No. 2014-193

Tax agent services legislation. The tax agent services legislation consists of: Tax Agent Services Act 2009 (TASA) – establishes the Tax Practitioners Board and provides for the registration and regulation of tax agents, BAS agents and tax (financial) advisers. act no. 6, 2014 pension funds amendment act , 2014 terms of the Income Tax Act, 1962 (Act No. 58 of 1962), may be taken by a member or beneficiary as a lump sum benefit as defined in the Second

1 Assessment of Republic Act 10963: The 2017 Tax Reform for Acceleration and Inclusion Rosario G. Manasan* 1. Introduction One of the Duterte administration’s major initiatives is the reform of the country’s tax system with the -4- Chairman Camp’s Discussion Draft of Tax Reform Act of 2014 and President Obama’s Fiscal Year 2015 Revenue Proposals March 18, 2014 on income within this broader tax base that exceeds the relevant statutory threshold.

Draft of the German Investment Tax Reform Act sent to associations for consultation. On 22 July 2015, (ECJ 10 April 2014, C-190/12) with respect to a possibly different tax treat-ment under the current investment taxation law of domestic and foreign in-vestment funds in connection with receiving German source 2.5dividends. Final- ly, it is also intended to prevent tax mitigation structures Tax agent services legislation. The tax agent services legislation consists of: Tax Agent Services Act 2009 (TASA) – establishes the Tax Practitioners Board and provides for the registration and regulation of tax agents, BAS agents and tax (financial) advisers.

Tax Provisions that Expired in 2014 ('Tax Extenders'). Tax Reform Act of 2014. A second option is to substantially revise or eliminate the current tax A second option is to substantially revise or eliminate the current tax system, instead relying on an alternative tax base for revenues (e.g., taxing consumption rather, Tax Reform Act of 2014 Discussion Draft (the discussion draft), released by House Ways and Means Committee Chair Dave Camp (R-MI) in February 2014. The NAM is the largest manufacturing association in the United States, representing.

The impact of federal tax reform on state corporate income

Pension Reform Act 2014 Key Highlights and Salient Points. act no. 6, 2014 pension funds amendment act , 2014 terms of the Income Tax Act, 1962 (Act No. 58 of 1962), may be taken by a member or beneficiary as a lump sum benefit as defined in the Second, Nigeria tax alert – July 2014 www.pwc.com All you need to know In brief On 1 July 2014, President Goodluck Jonathan signed into law the new Pension Reform Act 2014 which.

2014 House Tax Reform Proposal (H.R Library of Congress. This document1 provides a technical explanation of Title IV of the Tax Reform Act of 2014, a discussion draft 2 prepared by the Chairman of the House Committee on Ways and Means that proposes to reform the Internal Revenue Code., Tax Reform Act of 2014. A second option is to substantially revise or eliminate the current tax A second option is to substantially revise or eliminate the current tax system, instead relying on an alternative tax base for revenues (e.g., taxing consumption rather.

Client Alert June 30 2014 TAX REFORM ACT OF POTENTIAL

Japan Tax Update PwC. Tax and Superannuation Laws Amendment (2014 Measures No. 7) Act 2015 - C2015A00021 sch 6 (items 51-59) Tax Laws Amendment (Small Business Measures No. 2) Act 2015 - C2015A00067 Confident America,” released by the House of Representatives Republican Tax Reform Tax Force on June 24, 2016 (House blueprint); and (3) the Tax Reform Act of 2014, as introduced by former Chairman of the House Ways and Means Committee, Dave Camp, in December 2014 (Camp bill)..

tax reform code of 1971 - educational improvement tax credit, educational opportunity scholarship tax credit and contracting authority act of oct. 31, 2014, p.l. 2929, no. 194 cl. 72 Draft” of the Tax Reform Act of 2014, which sets forth his much-anticipated tax reform proposals. Of note, the Discussion Draft aims to transition the corporate tax rate to a flat 25% rate

-4- Chairman Camp’s Discussion Draft of Tax Reform Act of 2014 and President Obama’s Fiscal Year 2015 Revenue Proposals March 18, 2014 on income within this broader tax base that exceeds the relevant statutory threshold. 1 Assessment of Republic Act 10963: The 2017 Tax Reform for Acceleration and Inclusion Rosario G. Manasan* 1. Introduction One of the Duterte administration’s major initiatives is the reform of the country’s tax system with the

FEA Concerns with Draft Tax Reform Act of 2014 3-24-14 3 with their tax returns. Determination of whether the rules have been complied with is not complicated. [joint committee print] technical explanation, estimated revenue effects, distributional analysis, and macroeconomic analysis of the tax reform act of 2014,

Tax Reform Act of 2014 In February 2014, Congressman Dave Camp (R-MI), Chairman of the House Ways and Means Committee, released his long-awaited tax reform draft, the Tax Reform Act of 2014. This is a summary of the provisions that appear to be of interest to CIEBA plan sponsors. Camp Tax Reform Act of 2014 – Provisions of Interest to Higher Education ! Provision Estimate Details Other JCT Revenue (over 10 years) Relevant

Posts-125750-13 4 four years after enacting §280e, congress enacted the tax reform act of 1986, which added the uniformcapitalization rules of §263a to the code. Draft” of the Tax Reform Act of 2014, which sets forth his much-anticipated tax reform proposals. Of note, the Discussion Draft aims to transition the corporate tax rate to a flat 25% rate

n Feb. 26, 2014, the House Ways and Means Committee Chairman Dave Camp (R-Mich.) released draft legislation called the “Tax Reform Act of 2014” (Draft Legislation). Nigeria tax alert – July 2014 www.pwc.com All you need to know In brief On 1 July 2014, President Goodluck Jonathan signed into law the new Pension Reform Act 2014 which

Tax Reform Act of 2014 In February 2014, Congressman Dave Camp (R-MI), Chairman of the House Ways and Means Committee, released his long-awaited tax reform draft, the Tax Reform Act of 2014. This is a summary of the provisions that appear to be of interest to CIEBA plan sponsors. Tax Reform Act of 2014 Discussion Draft (the discussion draft), released by House Ways and Means Committee Chair Dave Camp (R-MI) in February 2014. The NAM is the largest manufacturing association in the United States, representing

1899 L Street NW • Suite 225 • Washington, DC 20036 • Phone: 202-986-2700 • Fax: 202-986-3696 • www.crfb.org Page 2 Summary of the Tax Reform Act of 2014 Draft” of the Tax Reform Act of 2014, which sets forth his much-anticipated tax reform proposals. Of note, the Discussion Draft aims to transition the corporate tax rate to a flat 25% rate

5 ‘‘Tax Reform Act of 2014’’. 6 (b) AMENDMENT OF 1986 CODE.—Except as other-7 wise expressly provided, whenever in this Act an amend-8 ment or repeal is expressed in terms of an amendment 9 to, or repeal of, a section or other provision, the reference n Feb. 26, 2014, the House Ways and Means Committee Chairman Dave Camp (R-Mich.) released draft legislation called the “Tax Reform Act of 2014” (Draft Legislation).

1 Assessment of Republic Act 10963: The 2017 Tax Reform for Acceleration and Inclusion Rosario G. Manasan* 1. Introduction One of the Duterte administration’s major initiatives is the reform of the country’s tax system with the [joint committee print] technical explanation, estimated revenue effects, distributional analysis, and macroeconomic analysis of the tax reform act of 2014,

act no. 6, 2014 pension funds amendment act , 2014 terms of the Income Tax Act, 1962 (Act No. 58 of 1962), may be taken by a member or beneficiary as a lump sum benefit as defined in the Second Draft” of the Tax Reform Act of 2014, which sets forth his much-anticipated tax reform proposals. Of note, the Discussion Draft aims to transition the corporate tax rate to a flat 25% rate